Discover how digital ecosystems, fintech and hybrid payment networks are reshaping digital financial inclusion across emerging markets.

Digital financial inclusion has become a central objective for governments, financial institutions, and fintech companies worldwide. Expanding access to digital financial services is no longer only a matter of innovation, but a key driver of economic growth, formalization, and social development—especially in emerging markets.

In this context, Banking as a Service (BaaS) has gained relevance in recent years. It refers to the ability of financial institutions to “rent” part of their assets—such as technology, infrastructure, licenses, data, or information—to third parties, enabling them to build and deliver financial products as part of their own value propositions.

Digital financial inclusion is a key driver of economic growth and resilience, particularly in emerging markets. The World Bank (2022) highlights that the expansion of digital payments and access to financial accounts has significantly reduced barriers to participation in the formal economy, reinforcing the role of technology and interoperable financial ecosystems in advancing inclusion. (Worldbank)

Although many traditional banks initially viewed this model with caution—due to the risk of cannibalizing their own products—today’s increasingly interconnected ecosystem and diverse user needs have made these alliances both necessary and strategic. Digital financial inclusion depends precisely on this type of collaboration, where banks, fintechs, and non-financial players work together to reach populations that were historically excluded from the financial system.

Key Banking as a Service Models Supporting Digital Financial Inclusion

To better understand how Banking as a Service contributes to digital financial inclusion, it is useful to group its services into three main categories:

1. Financial Data for Individuals and Companies

Driven by Open Banking, this model allows third parties to access customer data—always with user consent—through standardized APIs. Financial institutions enable services such as identity validation, credit scoring, and personalized financial products. By reducing information asymmetry, Open Banking plays a critical role in expanding access to credit and formal financial services.

2. Money Transfers and Account Movements

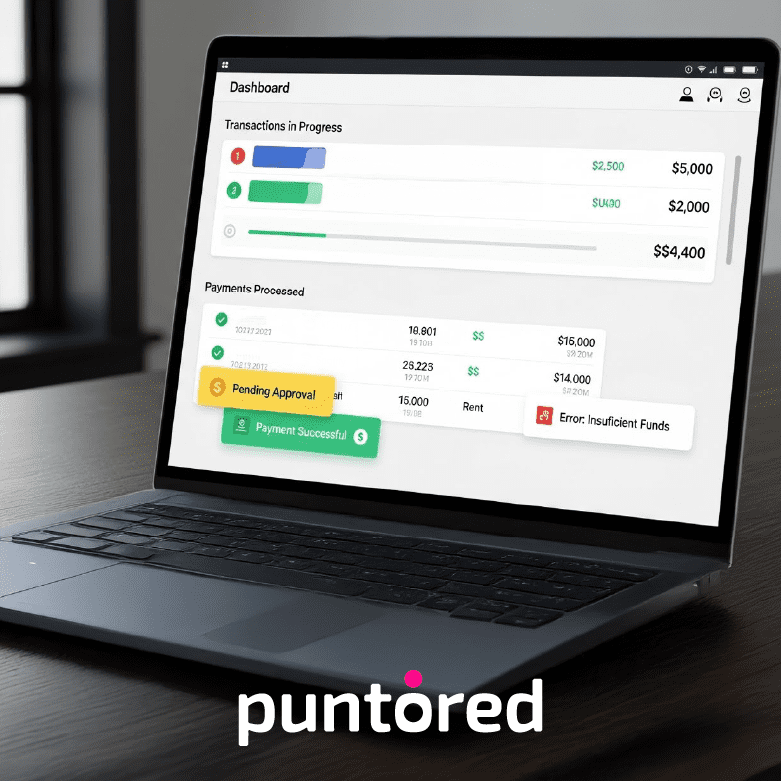

Once access to financial data is enabled, the next step is allowing debit and credit transactions. This capability supports use cases such as instant transfers, real-time disbursements, and digital payments inclusion, which are essential to reducing reliance on cash and improving liquidity for individuals and small businesses.

3. Debit and Credit Infrastructure

Under this model, banks provide their issuing or acquiring licenses so third parties can deliver financial services. Examples include fintechs issuing debit cards or merchant aggregators—such as Puntopay—operating under a bank’s acquiring infrastructure. These models significantly lower entry barriers and accelerate financial inclusion ecosystems.

Barriers Limiting the Impact of Digital Financial Inclusion

Despite its potential, the adoption of Banking as a Service and Open Banking still faces important challenges.

The first major barrier is technology. Many financial institutions continue to operate on legacy core banking systems that are not designed for easy integration with third parties via APIs. Migrating from these systems is costly and complex, limiting the speed at which banks can enable services such as real-time payments or open data access.

A second challenge lies in regulatory clarity. Innovation often moves faster than regulation, and for a highly regulated industry like finance, uncertainty can slow decision-making. In Colombia, significant progress has been made since 2020 to close the gap between regulation and market opportunities, particularly around Open Banking. However, this progress must be supported by timely decrees that clearly define the rules of engagement between banks and third parties.

Finally, market conditions can also restrict competition. If regulations or tax structures favor closed ecosystems, they can discourage innovation and raise costs for merchants and consumers. A well-known global example is China’s closed QR payment ecosystems, which concentrated market power in a few players and eventually triggered strong government intervention.

Colombia faces its own challenges. Several studies indicate that the country has relatively low adoption of low-value digital payments, largely due to high merchant costs, including withholding taxes and the 4×1000 tax. These frictions directly affect digital financial inclusion, especially for small merchants and informal businesses.

Fintech as a Service: Accelerating Financial Inclusion

Given these barriers, fintech companies with strong integration and interoperability capabilities are emerging as key enablers of digital financial inclusion. Over time, these companies have developed the technological infrastructure that allows banks and third parties to launch scalable, compliant, and user-centric financial products.

This model—often referred to as Fintech as a Service—enables financial institutions to participate in “products as a service” ecosystems without bearing the full technological burden. Beyond core financial services, these fintechs can integrate additional offerings such as insurance, telecommunications, content services, loyalty programs, and benefits platforms.

By aggregating data across multiple sectors and combining it with financial information, these ecosystems generate richer insights into user behavior and needs. Ultimately, this approach strengthens digital financial inclusion ecosystems, allowing more people and businesses to access relevant, affordable, and secure financial services.